You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Digital Currency

- Thread starter texasSlick

- Start date

- Status

- Not open for further replies.

texasSlick

VIP MEMBER

- Joined

- Jan 2, 2013

- Messages

- 4,194

Pointing out financial carnage is not meant by Me to come across in a negative way...or to depress folk..but to show for... one system to fail (collapse) helps the implementation of another which this post is titled

"..... one system to fail (collapse) helps the implementation of another ".... Very astute, Shane, as many of your posts are!

Slick

KiwiShane

VIP MEMBER

- Joined

- Mar 22, 2021

- Messages

- 2,378

Gold, Silver, and Oil Predictions; Ellison's FTX Testimony and the Sam Trabucco Mystery; Massively Eroded Dollar Sees the Fed Turn 109 — Week in Review

Gold, Silver, and Oil Predictions; Ellison's FTX Testimony and the Sam Trabucco Mystery; Massively Eroded Dollar Sees the Fed Turn 109 — Week in Review – The Weekly Bitcoin News

Robert Kiyosaki says the time to buy gold and silver is now, predicting a stock market crash will send prices of the precious metals higher.

Last edited:

KiwiShane

VIP MEMBER

- Joined

- Mar 22, 2021

- Messages

- 2,378

Well well...this will lead to some finger pointing surely ...so who's to blame ?

insiderpaper.com

insiderpaper.com

FTX boss Bankman-Fried pleads not guilty to US fraud charges - Insider Paper

FTX co-founder Sam Bankman-Fried pleaded not guilty Tuesday to US criminal fraud charges over the spectacular collapse of his crypto exchange. The 30-year-old former digital currency billionaire entered the plea in federal court in Manhattan after being released on bail last month following his...

Attachments

KiwiShane

VIP MEMBER

- Joined

- Mar 22, 2021

- Messages

- 2,378

GP was right again

Corrupt C***** Judge in the SDNY Rules that Two Entities Backing SBF’s Bail Can Remain Anonymous

Corrupt Bill C****n Judge Lewis Kaplan ruled today that two entities that backed Sam Bankman-Fried (SBF) would remain a secret per the request of those involved.Attachments

KiwiShane

VIP MEMBER

- Joined

- Mar 22, 2021

- Messages

- 2,378

LONDON — The price of gold notched a six-month high early Tuesday, and analysts believe the rally has further to go in 2023.

Spot gold peaked just below $1,850 per troy ounce before easing off to trade around $1,838 per ounce. U.S. gold futures were up 1% at $1,844.10.

Spot gold peaked just below $1,850 per troy ounce before easing off to trade around $1,838 per ounce. U.S. gold futures were up 1% at $1,844.10.

Attachments

grandpaul

VIP MEMBER

- Joined

- Jan 15, 2008

- Messages

- 13,288

I'm going to clarify my above previous reply:Bank balances are backed by FDIC, so nominal value up to whatever the limits are.

Of course, in certain situations, that means the FDIC triggers the "fed" (bankster's cabal) to print more play money, and you know what happens when they do that...

Bank balances of U.S. DOLLARS are backed by the FDIC.

Nobody anywhere will "protect" any other investment, except an insurance company.

Anyone care to investigate how much coverage you can get on digital "currency"? hee hee

KiwiShane

VIP MEMBER

- Joined

- Mar 22, 2021

- Messages

- 2,378

New Zealand is one of two countries that dont have this type of protection.. Legislation is due to be brought forward this coming year for NZ...so far its just been a bunch of happy talk.I'm going to clarify my above previous reply:

Bank balances of U.S. DOLLARS are backed by the FDIC.

Nobody anywhere will "protect" any other investment, except an insurance company.

Anyone care to investigate how much coverage you can get on digital "currency"? hee hee

But now with this self created global sovereign dept crisis we are now in...(excessive money printing)..we must do what one thinks is best to protect ourselves etc.

History has taught some of us that...in past volatile times of uncertainty...especially in pre war times.

KiwiShane

VIP MEMBER

- Joined

- Mar 22, 2021

- Messages

- 2,378

FINANCIAL TIMES OF LONDON

A New World energy Order is taking shape.

Global oil trade is De-dollarising slowly but surely

(Subscription bi-pass)

On Valentine’s Day in 1945, US president Franklin Delano Roosevelt met Saudi King Abdul Aziz Ibn Saud on the American cruiser USS Quincy. It was the beginning of one of the most important geopolitical alliances of the past 70 years, in which US security in the Middle East was bartered for oil pegged in dollars. But times change, and 2023 may be remembered as the year that this grand bargain began to shift, as a new world energy order between China and the Middle East took shape. While China has for some time been buying increasing amounts of oil and liquefied natural gas from Iran, Venezuela, Russia and parts of Africa in its own currency, President Xi Jinping’s meeting with Saudi and Gulf Co-operation Council leaders in December marked “the birth of the petroyuan”, as Credit Suisse analyst Zoltan Pozsar put it in a note to clients. According to Pozsar, “China wants to rewrite the rules of the global energy market”, as part of a larger effort to de-dollarise the so-called Bric countries of Brazil, Russia, India and China, and many other parts of the world after the weaponisation of dollar foreign exchange reserves following Russia’s invasion of Ukraine. What does that mean in practice? For starters, a lot more oil trade will be done in renminbi. Xi announced that, over the next three to five years, China would not only dramatically increase imports from GCC countries, but work towards “all-dimensional energy co-operation”. This could potentially involve joint exploration and production in places such as the South China Sea, as well as investments in refineries, chemicals and plastics. Beijing’s hope is that all of it will be paid for in renminbi, on the Shanghai Petroleum and Natural Gas Exchange, as early as 2025. That would mark a massive shift in the global energy trade. As Pozsar points out, Russia, Iran and Venezuela account for 40 per cent of Opec+ proven oil reserves, and all of them are selling oil to China at a steep discount while the GCC countries account for another 40 per cent of proven reserves. The remaining 20 per cent are in regions within the Russian and Chinese orbit. Those who doubt the rise of the petroyuan, and the diminution of the dollar-based financial system in general, often point out that China doesn’t enjoy the same level of global trust, rule of law or reserve currency liquidity that the US does, making other countries unlikely to want to do business in renminbi. Perhaps, although the oil marketplace is dominated by countries that have more in common with China (at least in terms of their political economies) than with the US. What’s more, the Chinese have offered up something of a financial safety-net by making the renminbi convertible to gold on the Shanghai and Hong Kong gold exchanges. While this doesn’t make the renminbi a substitute for the dollar as a reserve currency, the petroyuan trade nonetheless comes with important economic and financial implications for policymakers and investors. For one thing, the prospect of cheap energy is already luring western industrial businesses to China. Consider the recent move of Germany’s BASF to downsize its main plant in Ludwigshafen and shift chemical operations to Zhanjiang. This could be the beginning of what Pozsar calls a “farm to table” trend in which China tries to capture more value-added production locally, using cheap energy as a lure. (A number of European manufacturers have also increased jobs in the US because of lower energy costs there.) Petropolitics come with financial risks as well as upsides. It’s worth remembering that the recycling of petrodollars by oil-rich nations into emerging markets such as Mexico, Brazil, Argentina, Zaire, Turkey and others by US commercial banks from the late 1970s onwards led to several emerging market debt crises. Petrodollars also accelerated the creation of a more speculative, debt-fuelled economy in the US, as banks flush with cash created all sorts of new financial “innovations”, and an influx of foreign capital allowed the US to maintain a larger deficit. That trend may now start to go into reverse. Already, there are fewer foreign buyers for US Treasuries. If the petroyuan takes off, it would feed the fire of de-dollarisation. China’s control of more energy reserves and the products that spring from them could be an important new contributor to inflation in the west. It’s a slow-burn problem, but perhaps not as slow as some market participants think. What should policymakers and business leaders do? If I were chief executive of a multinational company, I’d be looking to regionalise and localise as much production as possible to hedge against a multipolar energy market. I’d also do more vertical integration to offset increased inflation in supply chains. If I were a US policymaker, I’d think about ways to increase North American shale production over the short to medium term (and offer Europeans a discount for it), while also speeding up the green transition. That’s yet another reason why Europeans shouldn’t be complaining about the Inflation Reduction Act, which subsidises clean energy production in the US. The rise of the petroyuan should be an incentive for both the US and Europe to move away from fossil fuels as quickly as they can.

rana.foroohar@ft.com This article has been amended to clarify that Zoltan Pozsar was referring to Opec+ proven oil reserves

KiwiShane

VIP MEMBER

- Joined

- Mar 22, 2021

- Messages

- 2,378

SBF and FTX peddled a crypto fraud that makes scammer Bernie Madoff look like an amateur

Crypto market's collapse exposes a giant, unregulated casino, hijacked by greed.

Attachments

KiwiShane

VIP MEMBER

- Joined

- Mar 22, 2021

- Messages

- 2,378

Pillow Talk Benefitting SBF?

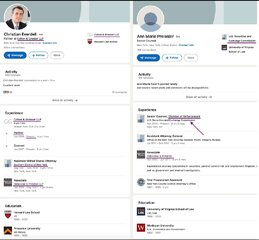

SBF's attorney, Christian Everdell, is married to Ann Marie Preissler, an attorney in the Division of Enforcement at the SEC's New York office.

January 8, 2023 by "reliable source"

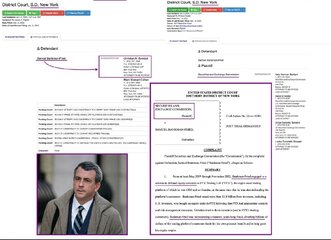

At the time of this writing, SBF has two attorneys in his criminal case (22-cr-00673) in the SDNY: Mark Cohen and Christian Everdell. The duo from Cohen & Gressler LLP represented sex trafficker Ghislaine Maxwell; Cohen is also the infamous “diversity monitor” who charged NYC $10 million to prod its departments to hire more minorities.

Mark Cohen, one of SBF’s attorneys for his criminal case in the SDNY

While SBF’s criminal case has generated the most headlines, Marco Polo noticed a familial connection between one of the entities suing SBF on the civil side—the Securities & Exchange Commission (SEC)—and Everdell. Indeed, Everdell’s wife is a “Senior Counsel” in the NY office of the SEC, the very office suing SBF (22-cv-10501).

Christian Everdell, SBF, & Everdell’s wife (Ann Marie Preissler)

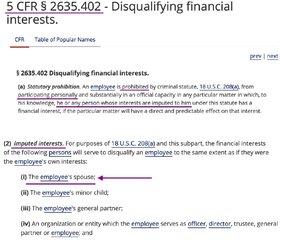

To ensure compliance with federal regulations, specifically 5 CFR § 2635.402 (b)(2)(i) (and, more broadly, 5 CFR § 2635.101 (b)(14), Preissler needs to recuse herself from the SEC’s action, as this scenario presents a clear conflict of interest. For example, Preissler, even though she is not listed on the SEC’s civil complaint, could be laundering information about the investigation/sources/methods to her husband, SBF’s attorney.

Marriage and NY Bar information for Christian Everdell & Ann Marie Preissler

LinkedIn profiles of Christian Everdell & Ann Marie Preissler

Federal regulations prohibit Preissler from “participating“ in the SEC v. SBF case

If Preissler does not recuse herself, it could be even more difficult to rectify the situation after the fact, as the couple could invoke “spousal immunity,” just as the infamous Secret Service agent Shaun Bridges did with his then-wife, Ariana Esposito.

The shotgun wedding of Shaun Bridges: on the banks of a river near Baltimore

Marco Polo contacted both Everdell & Preissler to give them a chance to comment on the potential conflict of interest; neither responded. Please write to her in order to ensure that she has recused herself from 22-cv-10501, as she is required to do: preisslera@sec.gov

SBF's attorney, Christian Everdell, is married to Ann Marie Preissler, an attorney in the Division of Enforcement at the SEC's New York office.

January 8, 2023 by "reliable source"

At the time of this writing, SBF has two attorneys in his criminal case (22-cr-00673) in the SDNY: Mark Cohen and Christian Everdell. The duo from Cohen & Gressler LLP represented sex trafficker Ghislaine Maxwell; Cohen is also the infamous “diversity monitor” who charged NYC $10 million to prod its departments to hire more minorities.

Mark Cohen, one of SBF’s attorneys for his criminal case in the SDNY

While SBF’s criminal case has generated the most headlines, Marco Polo noticed a familial connection between one of the entities suing SBF on the civil side—the Securities & Exchange Commission (SEC)—and Everdell. Indeed, Everdell’s wife is a “Senior Counsel” in the NY office of the SEC, the very office suing SBF (22-cv-10501).

Christian Everdell, SBF, & Everdell’s wife (Ann Marie Preissler)

To ensure compliance with federal regulations, specifically 5 CFR § 2635.402 (b)(2)(i) (and, more broadly, 5 CFR § 2635.101 (b)(14), Preissler needs to recuse herself from the SEC’s action, as this scenario presents a clear conflict of interest. For example, Preissler, even though she is not listed on the SEC’s civil complaint, could be laundering information about the investigation/sources/methods to her husband, SBF’s attorney.

Marriage and NY Bar information for Christian Everdell & Ann Marie Preissler

LinkedIn profiles of Christian Everdell & Ann Marie Preissler

Federal regulations prohibit Preissler from “participating“ in the SEC v. SBF case

If Preissler does not recuse herself, it could be even more difficult to rectify the situation after the fact, as the couple could invoke “spousal immunity,” just as the infamous Secret Service agent Shaun Bridges did with his then-wife, Ariana Esposito.

The shotgun wedding of Shaun Bridges: on the banks of a river near Baltimore

Marco Polo contacted both Everdell & Preissler to give them a chance to comment on the potential conflict of interest; neither responded. Please write to her in order to ensure that she has recused herself from 22-cv-10501, as she is required to do: preisslera@sec.gov

Attachments

-

Screenshot_20230108-123405_Telegram.jpg531.8 KB · Views: 50

Screenshot_20230108-123405_Telegram.jpg531.8 KB · Views: 50 -

Screenshot_20230108-123421_Telegram.jpg445 KB · Views: 41

Screenshot_20230108-123421_Telegram.jpg445 KB · Views: 41 -

Screenshot_20230108-123438_Telegram.jpg556.1 KB · Views: 38

Screenshot_20230108-123438_Telegram.jpg556.1 KB · Views: 38 -

Screenshot_20230108-123551_Telegram.jpg285.3 KB · Views: 41

Screenshot_20230108-123551_Telegram.jpg285.3 KB · Views: 41 -

Screenshot_20230108-123606_Telegram.jpg307.3 KB · Views: 52

Screenshot_20230108-123606_Telegram.jpg307.3 KB · Views: 52 -

Screenshot_20230108-123620_Telegram.jpg285.4 KB · Views: 53

Screenshot_20230108-123620_Telegram.jpg285.4 KB · Views: 53 -

Screenshot_20230108-123636_Telegram.jpg318.3 KB · Views: 51

Screenshot_20230108-123636_Telegram.jpg318.3 KB · Views: 51

KiwiShane

VIP MEMBER

- Joined

- Mar 22, 2021

- Messages

- 2,378

Yes and like you say will probably get off Scott free...though he could face 115 years...and his trial isn't till this October....what the f**k !!!Oh, what a tangled web that's ALL SPIDERS

Last edited:

robs ss

VIP MEMBER

- Joined

- Aug 16, 2016

- Messages

- 3,280

Do you sleep well Shane?

KiwiShane

VIP MEMBER

- Joined

- Mar 22, 2021

- Messages

- 2,378

Better than most why ?Do you sleep well Shane?

robs ss

VIP MEMBER

- Joined

- Aug 16, 2016

- Messages

- 3,280

Just the sheer volume of negative stuff. That's allBetter than most why ?

KiwiShane

VIP MEMBER

- Joined

- Mar 22, 2021

- Messages

- 2,378

Sheer volume of reality you mean. ?.....Just the sheer volume of negative stuff. That's all

....Now about the attachment of my post..

What did you find negative (volume) about the author of the video or his insight in regards to the current reality of our time. ??

I deleted my original attachment post as it x2.

This guy is aint negative ....far from it

Robert T. Kiyosaki ☝

Best known as the author of Rich Dad Poor Dad—the #1 personal finance book of all time—Robert Kiyosaki has challenged and changed the way tens of millions of people around the world think about money. He is an entrepreneur, educator, and investor who believes the world needs more entrepreneurs who will create jobs.- Joined

- Mar 7, 2020

- Messages

- 3,157

I'll be honest I don't follow this thread too deeply as it's mostly above my pay grade/intelligence level and I'm not 100% interested..... But in no way dismissive of those that are.

Might have taken it out of context, but that phrase: 'who believes the world needs more entrepreneurs ' DID catch my eye...

Why? I can't remember who, but I do recall one of our Brit prime ministers using the same line a few years back, and looking at our current shortage of both skilled and unskilled labour I can't help but think it might not have been the best of ideas??

But please, take my comment as from one who admits ignorance in these things

Might have taken it out of context, but that phrase: 'who believes the world needs more entrepreneurs ' DID catch my eye...

Why? I can't remember who, but I do recall one of our Brit prime ministers using the same line a few years back, and looking at our current shortage of both skilled and unskilled labour I can't help but think it might not have been the best of ideas??

But please, take my comment as from one who admits ignorance in these things

- Status

- Not open for further replies.